Apply for a DCU Visa® Platinum Card

Enjoy a credit card with a low rate and no balance transfer fees.

LEARN MOREStop paying big bank fees. Make the Switch to DCU.

Let us help you save money on your next loan.

Online calculators to help you make informed and educated decisions.

We provide a range of free services and ways to making banking easier.

Stop paying big bank fees. Make the Switch to DCU.

No Recent Searches Found

Did you mean:

Sorry, We couldn't find what you are looking for. It could be because of many reasons.

DCU Routing Number: 211391825

Sorry, We couldn't find what you are looking for. It could be because of many reasons.

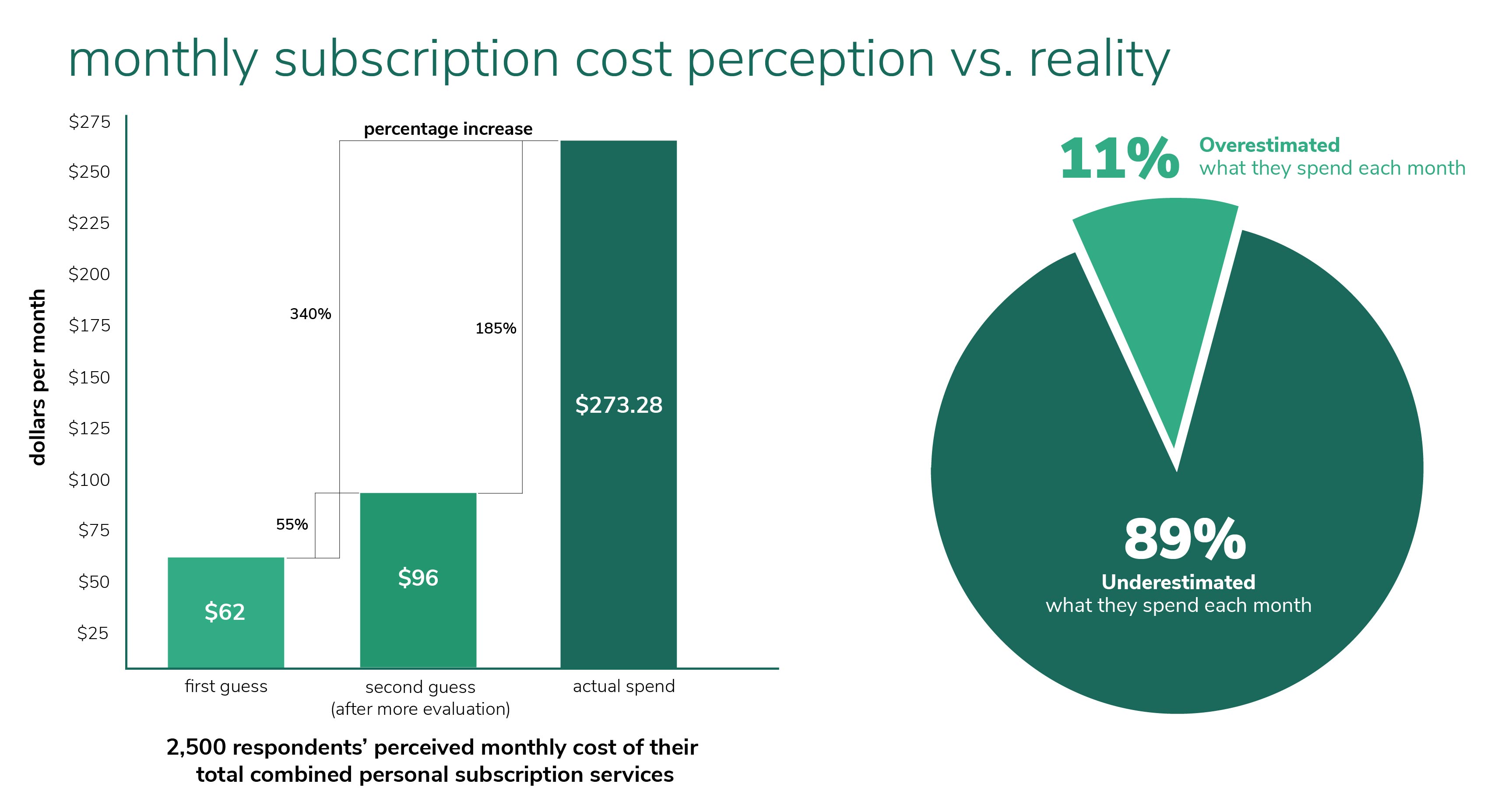

Trying to save some extra money? Consider reviewing how much you spend on subscription services in order to cut some unnecessary spending out of your monthly budget. In fact, a 2021 study revealed that most Americans vastly underestimate how much they spend on subscriptions by a whopping 340%! To get a holistic view of how much you actually spend on recurring services, consider making these four simple moves.

Enjoy a credit card with a low rate and no balance transfer fees.

LEARN MOREPlease note, membership is required to open a DCU Visa® Platinum credit card. Visit our membership eligibility page for more information.

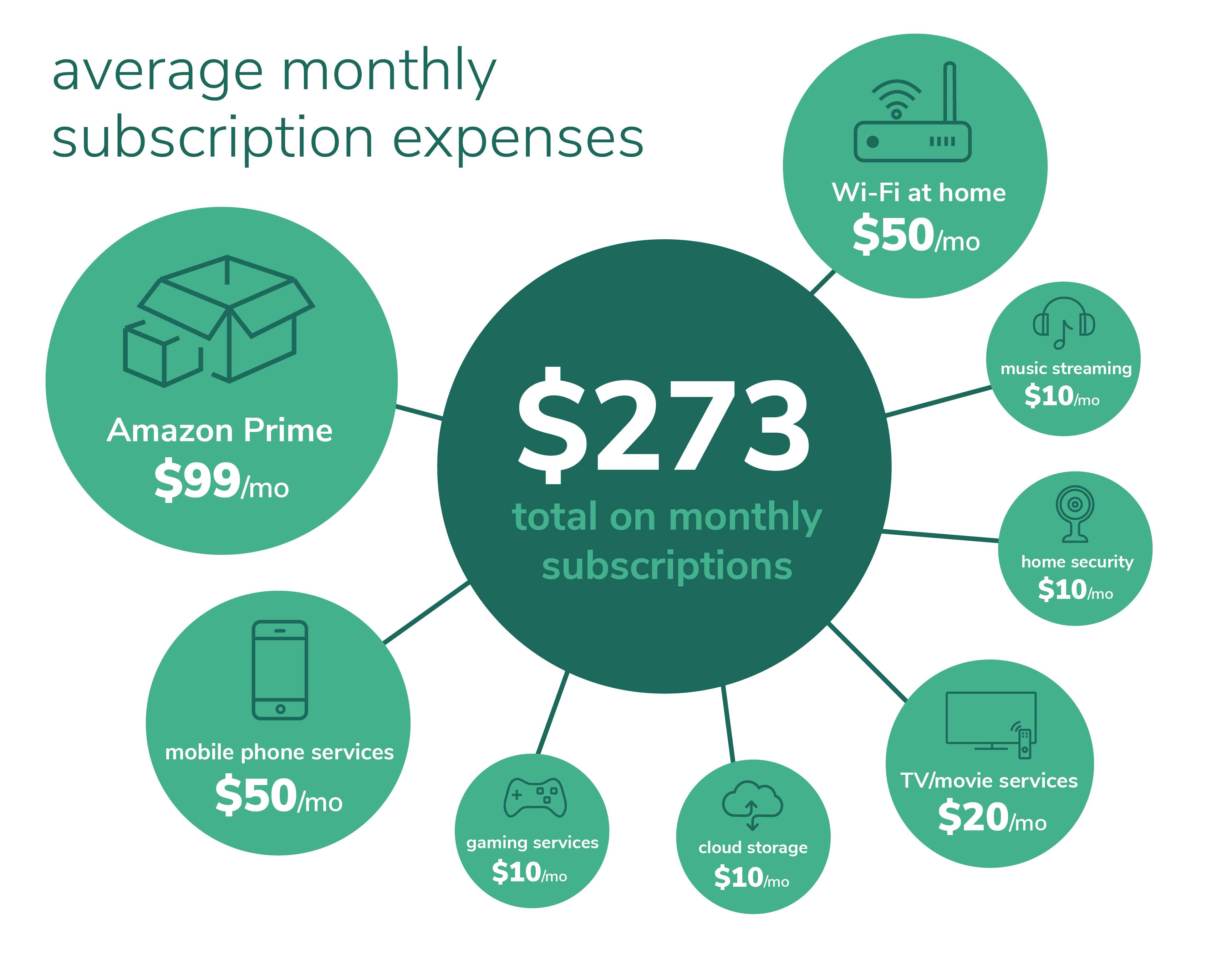

You might think the biggest culprits siphoning off your budget each month are streaming services like Netflix, Hulu, and Amazon Prime. With more and more streaming options hitting the market (Disney+, anyone?) these expenses can quickly add up. But don’t forget, there are many other categories that fall under automatic charges each month. Music, subscription boxes, gym memberships, cloud storage, food deliveries, and smartphone app charges all eat away at your budget. Subscription management apps like Rocket Money can help you identify these subscriptions by crawling your bank or credit card statements and finding recurring charges. An additional benefit is they may help you get better rates on existing bills by negotiating on your behalf.*

Once you realize how much you’re spending on subscriptions monthly, cut back on the extra services you don’t use frequently. Doing this audit shouldn’t be a one-time task; instead try to make it at least a quarterly habit. After all, you’re likely to add new expenses as your interests shift and you should make sure you’re still using the existing subscriptions. Set a calendar reminder to unsubscribe from unused services on a regular basis. There are a variety of apps that will review your subscriptions and prompt you to cancel if you haven’t used them recently.

As you free up additional cash from subscription services, don’t spend it on extraneous things. Assign that money to a new savings goal to stay motivated and mindful of your spending. Try using this streaming calculator to determine how much those monthly costs add up over a lifetime. Seeing the total figure over the course of decades illuminates how much you could save up for other worthwhile goals.

Subscription services aren’t a bad thing. They’re convenient and can keep you from spending on more expensive items, like going out to the movies or buying every new album you like. You can enjoy your subscription services and easily keep track of them by maintaining all these recurring charges on the same card. Consider utilizing your DCU Visa® Platinum credit card to consolidate your costs and easily review your subscription spending on a monthly or quarterly basis by reviewing your credit card statements.

Don’t have a DCU Visa® Platinum credit card? Apply now, and get smarter about tracking your spending with a low rate and no balance transfer fees.

How do you start saving more? One effective method is to track your spending. Small changes in how you spend can add up to big savings over time.

Feeling the squeeze on your budget? There are some small ways to continuing saving, even when your income is stretched.

Determine how much you can save over time with monthly deposits.

©

Digital Federal Credit Union. By using this site, you accept DCU's Terms of Use and Privacy Practices.

You are about to enter a website hosted by an organization separate from DCU. Privacy and security policies of DCU will not apply once you leave our site. We encourage you to read and evaluate the privacy policy and level of security of any site you visit when you enter the site. While we strive to only link you to companies and organizations that we feel offer useful information, DCU does not directly support nor guarantee claims made by these sites.